The transitory inflation argument continued

George Kessarios

Chief Economist & Fund Manager

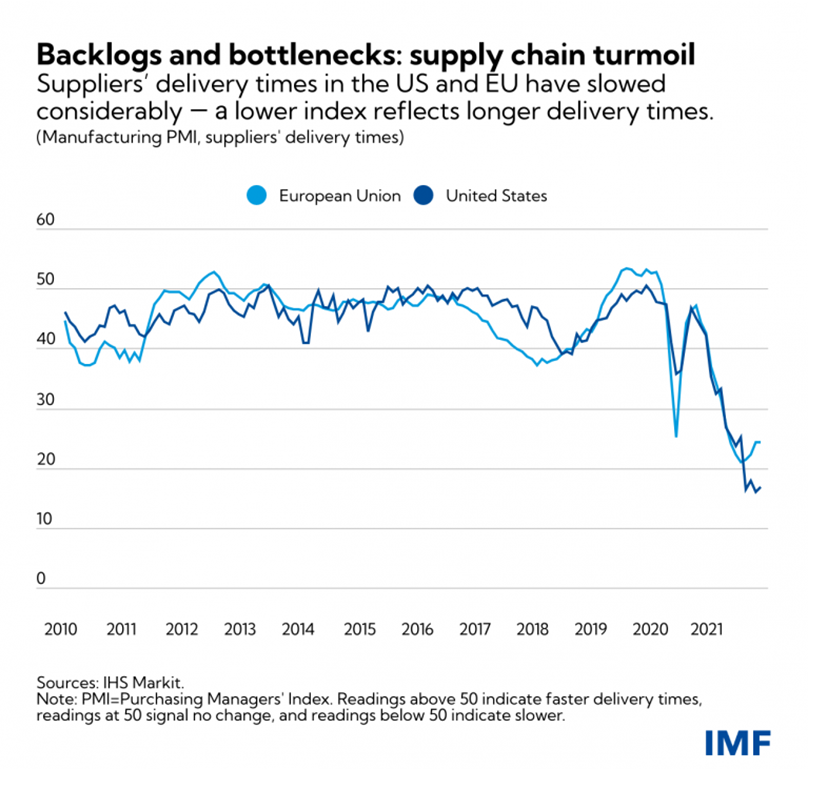

The chart below comes to us from the IMF. In short, it is depicting the supply chain turmoil around the world and how it is impacting delivery times. A reading above 50 indicates faster delivery times and a reading below 50, slower delivery times.

This partially explains the higher inflation we are witnessing. How so? Well, supply chain bottlenecks and thus slower delivery of goods have always been associated with higher inflation. One example is the oil crisis of the 70s, that was responsible for higher energy prices ,and higher inflation.

However, supply chain bottlenecks don’t last forever. At some point a return to normality and a reading at around 50 will return. Put in another way, at some point supply and demand will once again find balance.

In fact, what some economists are worrying about is that in the next 12 months we might have much more supply than demand. This because, today we have pent up demand and supply constraints. But with so much pull forward demand, when balance returns, we might find ourselves with more supply than demand. Obviously it’s still early to tell what will happen, but it is something that we are following very closely.

But don’t expect all inflation components to find themselves at pre COVID levels. Wages for example are not expected to fall. However, that is probably a good thing for most people than anything else.

The bottom line is that yes inflation is higher and might be with us for a while, however it’s difficult to see the inflation of the 70s return anytime soon. And while many can blame Central Bank policies for the current inflationary pressures, at the end of the day the main culprit is supply chain bottlenecks than anything else.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.