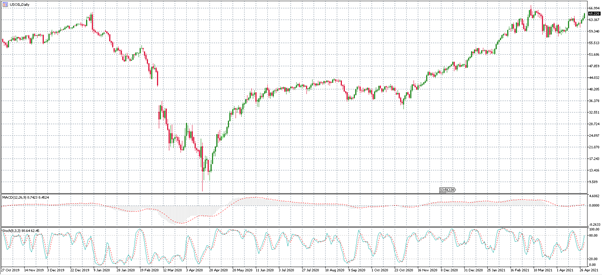

WTI crude oil rallies above $65/barrel over a robust demand recovery

Vrasidas Neofytou

Head of Investment Research

WTI crude oil contract extends recent massive gains into Thursday’s trading session, jumping by 2.5% to $65.30/barrel on growing optimism over signs of a higher fuel demand recovery for the rest of the year despite global pandemic-led demand concerns.

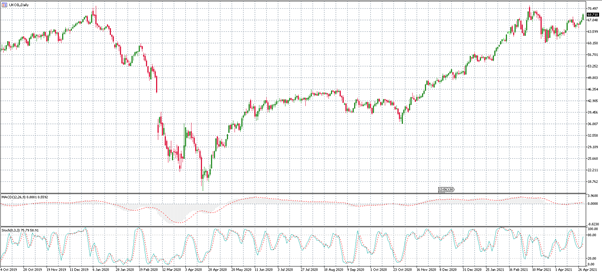

Brent crude underperforms WTI crude:

The international benchmark Brent crude posts the same upside momentum but with softening pace than its US counterpart WTI. Even though Brent’s price reached the resistance level of $70/barrel, the discount with WTI’s front-month contract was the smallest in more than a week, by $3-$4/barrel only.

The reason for the WTI outperformance against the Brent contract is that the OPEC+ alliance will start gradually easing their oil supply restrictions from May to July.

Crude oil demand and Covid-19:

The faster-than-expected Covid-19 vaccination campaigns in some of the larger oil consumer countries such as the USA, Great Britain, China, and some parts of Europe and Asia has enabled their economies to rapidly ease social restriction measures, allowing the demand recovery for gasoline, diesel, and other petroleum products to pre-pandemic levels.

China, which has managed to exit first from the devastating pandemic last year, has grown by more than 18% in the Q1,2021, recovering the demand for crude oil to pre-pandemic levels as well.

On the other hand, the energy investors worry about the resurging Covid-19 infections cases in India, the world’s third-largest oil consumer. India, together with Japan and Brazil have seen their Covid-19 cases rising to record levels, which could harm the oil demand.

OPEC’s & Goldman Sachs bullish oil demand outlooks:

WTI and Brent crude oil prices have gained more than 6% since Wednesday, following OPEC’s slight upgrade of its demand growth outlook for 2021 to 6 million barrels per day, while the group also expects global stocks to reach 2.95 billion barrels in July, taking them below the 2015-2019 average.

The US investment bank Goldman Sachs is forecasting the price of Brent to reach $80/barrel and the price of US West Texas Intermediate (WTI) to advance towards $77/barrel over the six-month period.

The bank forecasts a record jump in global oil demand, following the acceleration of vaccinations in Europe and an unleashing of pent-up travel demand, which will lead global jet demand to recover by 1.5 million bpd.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.