Global equities hit record highs on US stimulus bill and Brexit deal

Vrasidas Neofytou

Head of Investment Research

Global equities rallied strongly at the start of the final trading week of 2020, as investors celebrate the Brexit trade agreement, the start of vaccinations in Europe, the positive news over AstraZeneca’s vaccine and the signing of the well-expected US Covid-19 relief package by President Trump.

US stimulus relief package:

Appetite for riskier assets increased this week after US. President Donald Trump signed a $900 billion coronavirus relief package into law on Sunday. Trump prevented a government shutdown late Sunday, extending the unemployment benefits into March for an estimated 14 million people in the USA. The new package includes a $600 direct payment to most individuals and adds $600 for every child.

President Trump suggested last week to veto the legislation demanding $2,000 direct payments instead of $600. The House voted Monday to increase the second round of federal direct payments to $2,000, leaving it up to the GOP-controlled Senate.

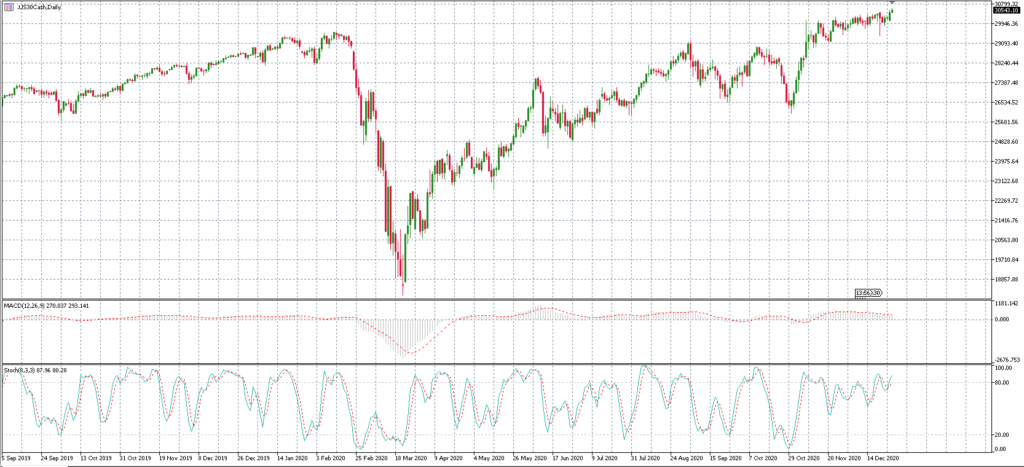

The stimulus-led market euphoria sent the industrial Dow Jones to close at fresh record highs of 30.400, up 0.7%, while S&P 500 and Nasdaq finished on Monday higher by 0.9% to 3.735 points and 0.7% to 12.900 points respectively, reaching new all-time highs as well.

Dow Jones and S&P 500 gained 6% and 15% respectively in 2020 recovering all Covid-led losses. However, it was the technology-focus Nasdaq Composite that outperformed the whole market, adding more than 45% in the same period as investors felt safe to position their funds into pandemic-winner tech names such as Netflix, Amazon, Zoom, and Apple.

Brexit trade deal and AstraZeneca’s vaccine:

Germany’s DAX index finished up 1.5% on Monday, erasing almost all pandemic-led losses, while France’s CAC rose 1.3%, on Brexit deal optimism, AstraZeneca vaccine news, and the start of mass vaccinations in Europe.

Britain’s FTSE 100 hit 8-month highs at 6.660 points on Tuesday after the drug maker AstraZeneca announced that its COVID-19 vaccine candidate is set to be granted emergency use approval from UK regulators this week. Hence, the company believes that its vaccine would be effective against a new variant of the virus that has helped drive a spike in cases in Britain.

European investors also cheered the long-awaited Brexit trade deal between the European Union and Britain last week. Euro and Pound Sterling currencies rose to 2 ½ year highs against the US dollar.

Asian Markets:

Equities in Asia were higher this morning, following the overnight gains on Wall Street. The Japanese index Nikkei 225 finished Tuesday’s session with 2% gains at 27.560 points, trading at levels not seen since 1990. South Korea’s Kospi finished the day at 2.820 points, up 0.50%, hitting fresh all-time highs, the Hang Seng gained 1% near yearly highs, while Australia’s ASX 200 rose 0.50%.

Crude oil gains:

Crude oil rose on Tuesday along with gains in global equities, over the growing optimism that the fresh US stimulus bill combined with the expectation for a global economic recovery in 2021 would increase the demand for petroleum products.

WTI and Brent crude prices added 1% yesterday, to $48 and $51 per barrel respectively erasing most of last week’s losses propelled from concerns over the new fast-spreading Covid variant in the UK.

Market outlook for 2021:

The market outlook for 2021 will remain bullish if the pandemic-damaged global economies will be supported by the ongoing massive monetary and fiscal stimulus, the low-interest rates, the weaker US dollar, and the successful mass vaccination of the global population which will allow economies to reopen after the devastating COVID-19 pandemic.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.